The RWAfi Money Market

Lend, borrow and leverage your assets on Plume's native money market.

$0

Total Deposits

$0

Total Borrowed

$0

Total Liquidity

Trusted by

The home of DeFi on Plume

The home of DeFi on Plume

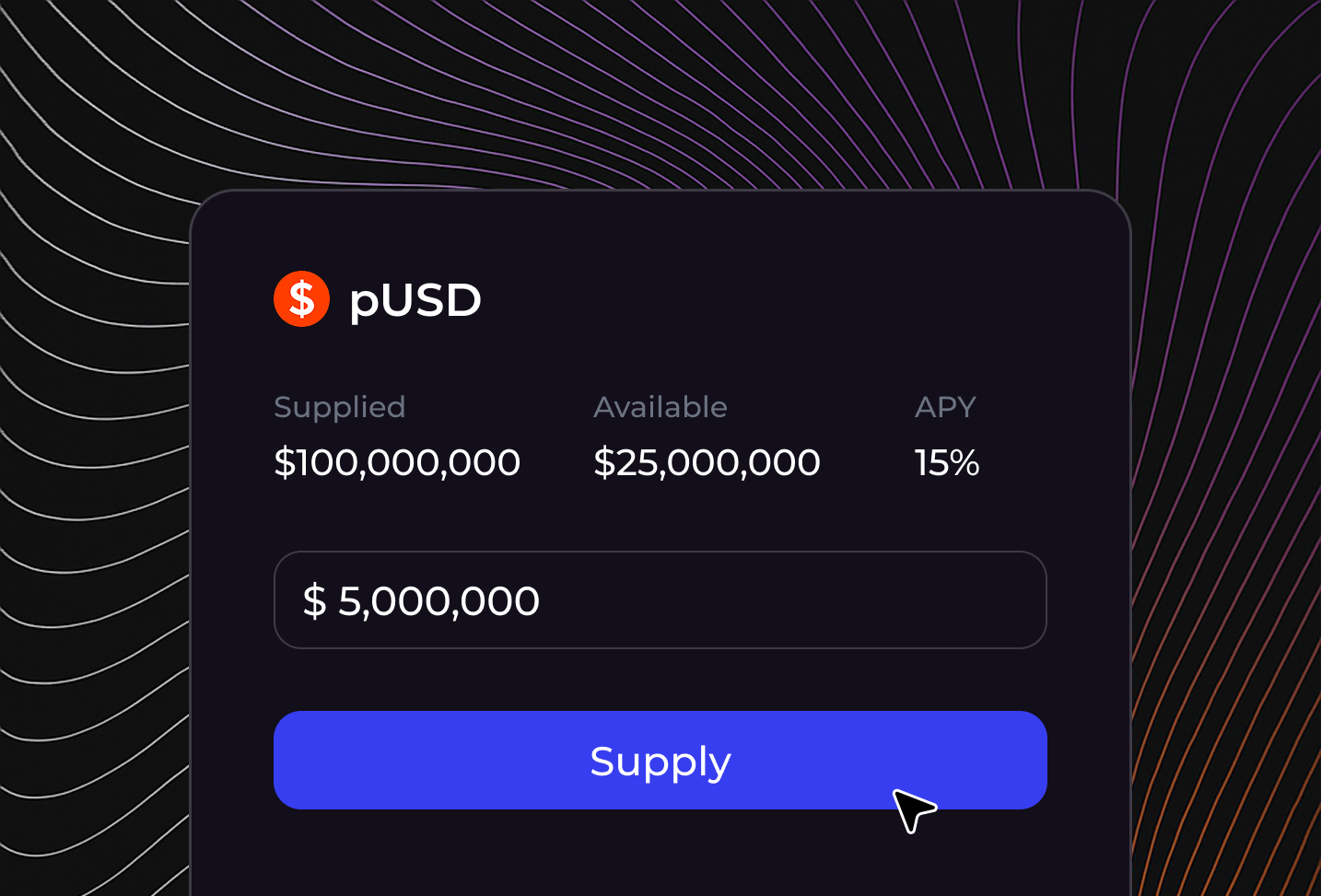

Earn interest on your assets by supplying to the protocol.

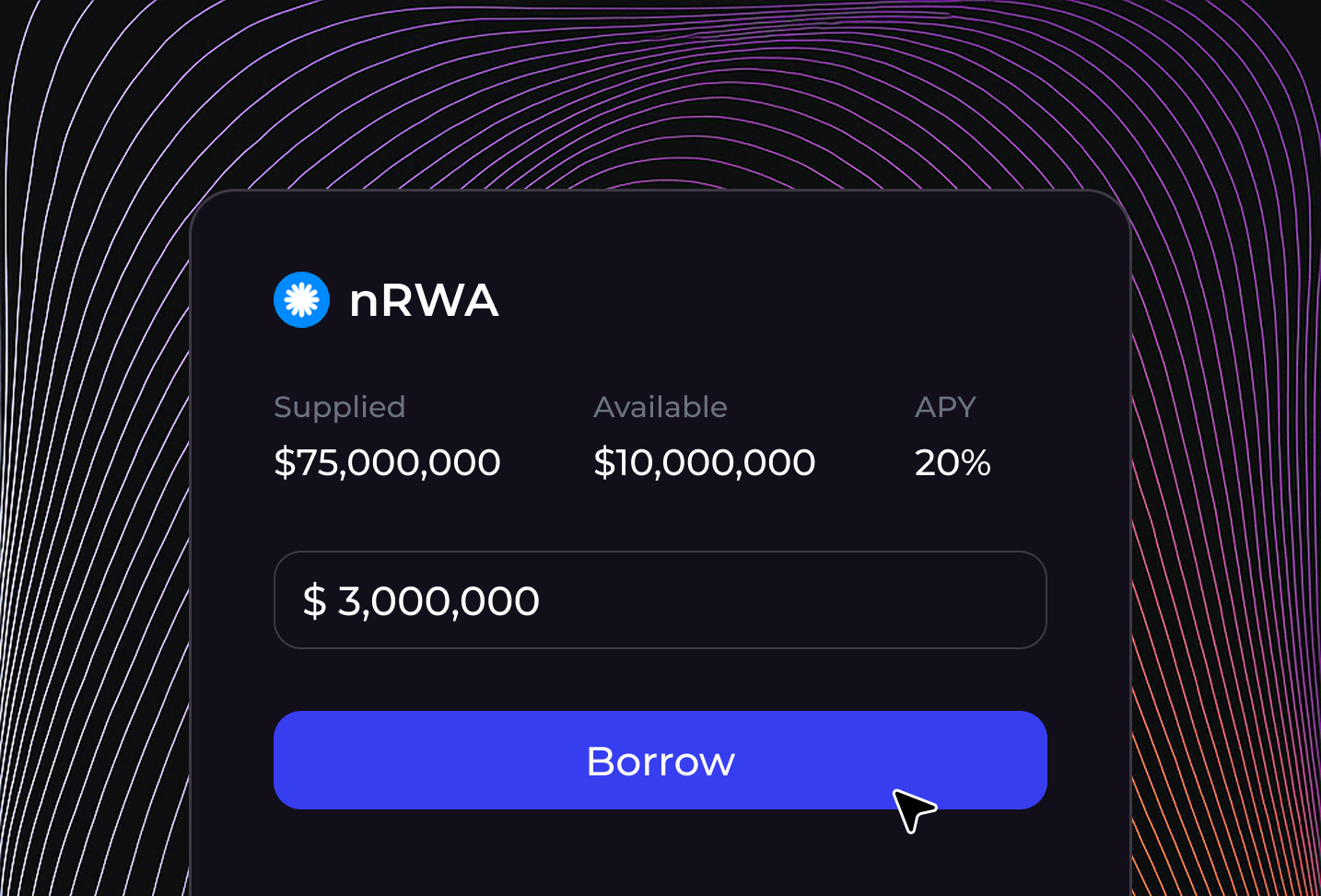

Borrow against your collateral and unlock liquidity.

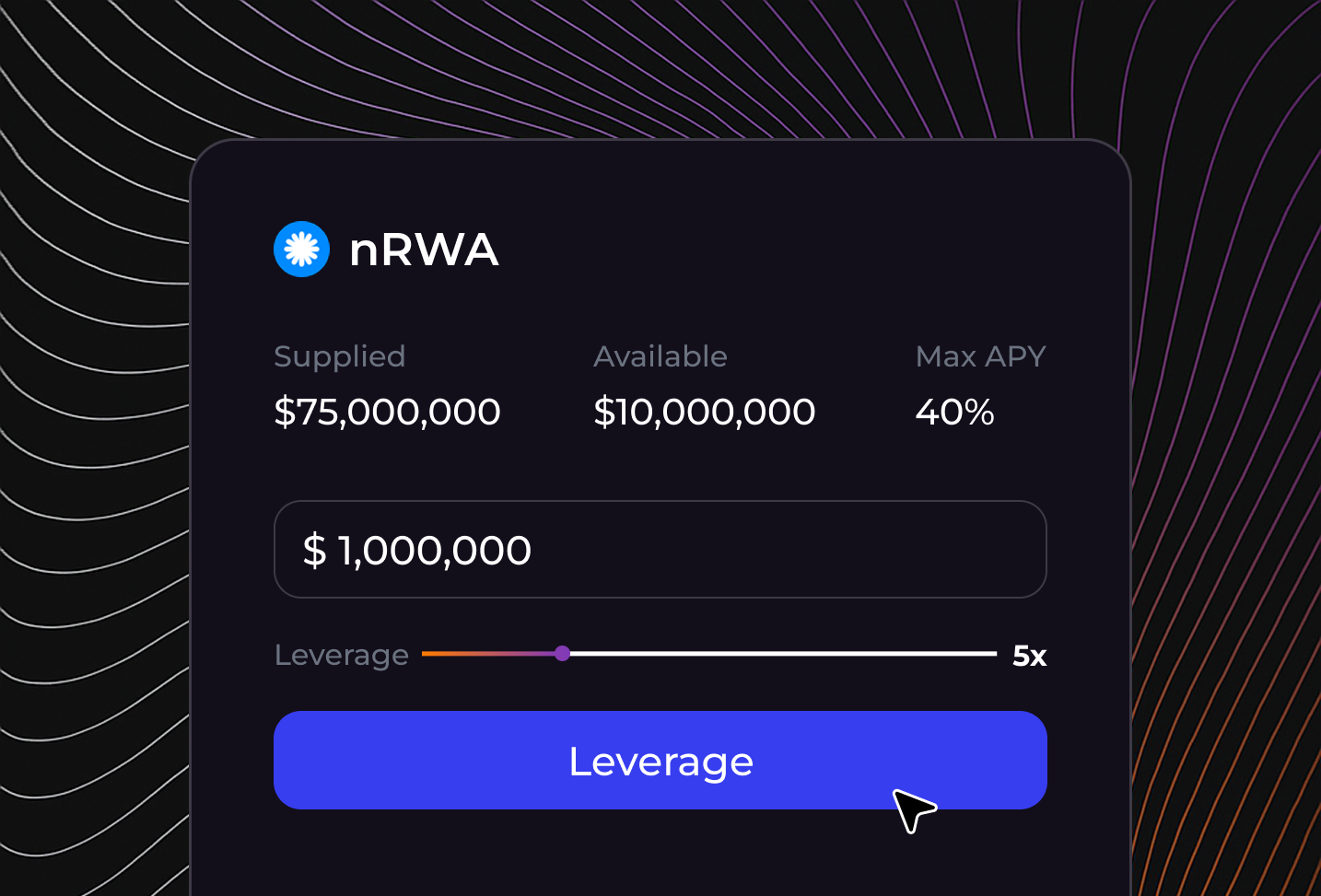

Leverage your assets and multiply your earnings.

Stake your PLUME, get stPLUME and use it in DeFi. stPLUME is Plume's leading LST.

Curate on Mystic

Vault Curation

Mystic is the home of Morpho markets on Plume. With our innovative structured vaults primitive built on top of Morpho, unique markets can be curated on Mystic. Get involved now and start earning fees for curating.

Build on Mystic

Create your own lending experience

Mystic is finance, for all. Work with us to enable yield for your users or build your own lending experience on top of Mystic. Whatever the use case, we've got you covered.

Institutional-grade Security

RWA Risk Management

Cicada is Mystic's strategic risk manager, focused on monitoring DeFi and RWA risk across the protocol.

Learn More